My Opinion | 128690 Views | Aug 14,2021

Mar 23 , 2025

By Million Kibret

Drawing parallels with the Nairobi Securities Exchange, Kenya’s experience displays the impact of well-crafted policies and technological progress. Ethiopia is at the cusp of similar potential, learning from its neighbour’s advancement in transparent, technology-driven, and diverse capital market offerings. By capitalising on Kenya's lessons, Ethiopia could chart its path, adapting these insights to its unique economic conditions. Investors will look for transparency in trading practices and regulatory prudence as keys to ESX's credibility, writes Million Kibret, managing partner for BDO Ethiopia.

The launch of the Ethiopian Securities Exchange (ESX) in January this year marked a landmark event in Ethiopia’s financial history. It arrived at a time when Kenya had already established itself as an Eastern African financial powerhouse through the Nairobi Securities Exchange (NSE).

Decades of structured reforms, regulatory vigilance, and new products helped turn the NSE into one of the region’s most vibrant capital markets. Ethiopia’s goal is to adopt and adapt similar strategies, while respecting the realities of its economy.

Historically, Ethiopia’s financial sector has been dominated by banks holding 96pc of total financial assets. That dominance gave businesses few avenues to raise funds besides bank loans, often saddling them with liquidity shortages and high borrowing costs. By creating the ESX, the authorities hope to open up equity and debt markets, making it easier for firms to tap capital for expansion. This aligns with the Homegrown Economic Reform agenda, designed to modernise the economy and attract foreign investors.

Although the authorities recently revised the credit growth caps by four percentage points from 14pc, which was first introduced in 2023, many businesses still struggle to secure adequate financing. Officials see the new Exchange as a vehicle to reduce these constraints and enable a more dynamic financial ecosystem.

Policymakers' ambitions also include diversifying its economy beyond agriculture, which has long been prone to weather shocks and price swings. The ESX could help smooth out some of these vulnerabilities by channelling capital toward the industrial and service sectors. Small and medium enterprises may be among the biggest beneficiaries, finally gaining broader financing options.

Economic growth is projected to hit 8.4pc by 2026, which gives policymakers confidence that the timing is right for a capital market. Yet, limitations remain. Macroeconomic concerns, such as inflation and external debt, can scare off investors. Real estate occupies a large share of the economy, heightening the risk of sectoral downturns spilling over. The banking system’s liquidity limits could also constrain early trading on the Exchange. As the regulator, the Ethiopian Capital Market Authority (ECMA) should demonstrate that it can enforce unambiguous rules and protect investors. Without such trust, the ESX may struggle to gain momentum.

The Exchange's establishment through a public-private partnership (PPP) model demonstrates a shared commitment between government and private stakeholders to ensure sustainable market development. This partnership could boost investor confidence, as it signals that policy and commercial interests are aligned. If managed well, the PPP structure could allow expertise and capital from both sides to guide the Exchange’s long-term growth.

Kenya’s track record illustrates how well-crafted policies and capable oversight can stimulate capital market growth.

The Kenyan economy, expected to expand by around five to 5.5pc in 2025, draws on a range of sectors, including agriculture, telecommunications, and infrastructure, that underpin the NSE. Market capitalisation reached 16 billion dollars in February 2025, partly due to investor confidence built up over the years. The Capital Markets Authority (CMA), created in 1989 to oversee development and align regulations with IOSCO standards, is at the core of Kenya's framework. A risk-based monitoring model lets the Authority focus on areas most susceptible to misconduct, encouraging innovation and boosting confidence.

Another turning point for the NSE was its demutualisation in 2014, transforming it from a member-owned institution into a more transparent, profit-driven entity. Kenya also upgraded its technology, automating equity trading in 2006 and debt trading in 2009, while improving its Central Securities Depository. These changes curtailed settlement risks and slashed transaction costs, drawing in domestic and foreign investors alike. Over time, the NSE introduced new products, including Real Estate Investment Trusts (REITs), derivatives, Exchange-Traded Funds (ETFs), and electronic Initial Public Offerings (e-IPOs). This variety attracted different types of investors and gave companies more avenues to raise capital.

Kenya’s strategy of opening its market to global participants injected liquidity and broadened the investor base, though it also entailed safeguarding domestic interests.

The NSE now features 65 listed companies from the banking, manufacturing, telecommunications, and agriculture sectors. Government bonds remain a cornerstone, offering stable returns and benchmarks for the broader fixed-income market. Corporate bonds add an alternative for firms seeking capital, though typically at higher yields than sovereign debt. Collective Investment Schemes, such as unit trusts, have widened market access by letting retail investors pool funds, while REITs have helped finance real estate development in a country hungry for housing.

This progression displays how a capital market can anchor economic growth.

Ethiopia hopes to follow suit. A robust regulatory framework is the starting point, as investors expect transparency in trading practices, disclosure rules, and dispute resolution. The ECMA could adopt a risk-based approach modelled on Kenya’s, first channelling its resources to the highest-risk segments. Financial literacy campaigns may help ordinary citizens grasp the benefits and pitfalls of market participation, building a healthy retail investor base.

Compensation mechanisms or insurance schemes to protect investors from broker insolvency or fraudulent practices could go a long way toward boosting confidence.

Beyond regulation, the authorities should create incentives for participation. Kenya offered tax breaks and discounted listing fees in its early days to motivate companies to go public. Ethiopia could replicate such tactics, lowering barriers to listing and encouraging issuers to tap the new Exchange. Foreign investors may bring crucial liquidity, but local authorities might limit ownership in sensitive sectors or introduce gradual caps to safeguard domestic interests. Striking this balance is essential to ensure the ESX grows without triggering unintended consequences.

Technology will likely be another pillar of success. Efficient trading systems and reliable clearing can reduce operational hiccups and settlement delays. To broaden access, particularly for potential investors outside major cities, they might look at e-IPOs or mobile trading platforms. Distributed ledger technology could also help streamline registration and settlement, lowering costs and boosting transparency. Getting these systems right from the start can prevent growing pains later.

Product diversity stands out as a lesson from Kenya’s playbook. A government bond market can anchor the ESX with stable yields and a benchmark for corporate debt. From there, Ethiopia might branch into corporate bonds, ETFs, REITs, and possibly Islamic finance offerings. Including microfinance institutions and cooperatives in the broader ecosystem could further integrate smaller savers. The result could be a capital market that supports corporate financing and promotes financial inclusion.

None of this can happen without trained personnel and capable institutions.

Regulators, brokers, and issuers all need expertise in capital markets. Partnerships with the African Development Bank, the United Nations Development Programme, Financial Sector Deepening Africa, or Kenya’s CMA could jump-start capacity building. Well-structured training programs and knowledge transfers might help Ethiopia avoid missteps in its early development. Experts also point to the importance of specialised teams within the ECMA to handle complex products, ensuring the market evolves smoothly as it diversifies.

The ESX’s launch undoubtedly opens a new chapter in Ethiopia’s economic story. Diminishing dependence on traditional banking channels could stimulate corporate growth and state-led infrastructure or social development initiatives. Yet, success will depend on macroeconomic stability, prudent regulation, and a willingness to adjust policies as conditions evolve. Foreign investors eyeing the Ethiopian market will want reassurance that the rules are clear, contracts are honoured, and risks are well-managed.

Kenya’s experience confirms that capital markets can adapt, even through bouts of volatility, if anchored by solid oversight and responsive innovation. The Nairobi Securities Exchange has faced market swings but continues to refine its framework and expand product offerings. Ethiopia can study Kenya’s approach — especially how it balanced liberalisation with protective measures — while tailoring its own policies to local priorities.

This venture also aligns with a broader regional trend toward financial integration. If Ethiopia’s market matures, the possibility of cross-border listings or linkages with other African exchanges grows more realistic. Such connections might eventually grant Ethiopian businesses and investors access to deeper liquidity pools, spurring more cross-border financing. But for now, the focus should remain on making the ESX an efficient, trustworthy, and liquid market at home.

Building that trust will take time. Investors will watch closely for how regulators handle early cases of misconduct or disputes, and whether disclosure standards match international norms. Early successes, such as smooth listings or bond issuances, could help set a positive tone. If authorities can navigate this rollout effectively, through prudent regulation, technological investments, and partnerships, then January 10, 2025, may be remembered as the day Ethiopia took a bold step toward a more diverse, resilient, and globally connected financial future.

Ethiopia’s experiences will not mirror Kenya’s in every detail. Nor should it be as domestic realities — from inflation rates to political considerations — will shape the ESX. Still, Kenya’s story of deliberate reforms and market openness can serve as a useful guide for what can go right when the authorities commit to transparency, innovation, and steady oversight. The distance between where Ethiopia stands now and where Kenya’s NSE has arrived shows the challenges and the possibilities.

If Ethiopia seizes this opportunity, the ESX could evolve into a pillar of national development, channelling investment to sectors that need it most and offering new horizons to businesses and citizens alike.

PUBLISHED ON

Mar 23, 2025 [ VOL

25 , NO

1299]

My Opinion | 128690 Views | Aug 14,2021

My Opinion | 124938 Views | Aug 21,2021

My Opinion | 123020 Views | Sep 10,2021

My Opinion | 120834 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

May 3 , 2025

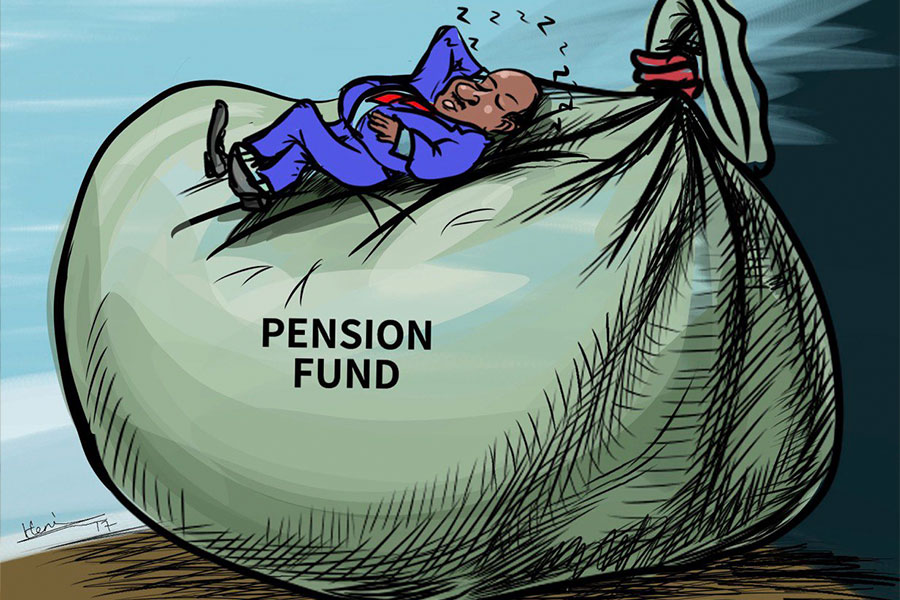

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...

Apr 26 , 2025

Benjamin Franklin famously quipped that “nothing is certain but death and taxes.�...

Apr 20 , 2025

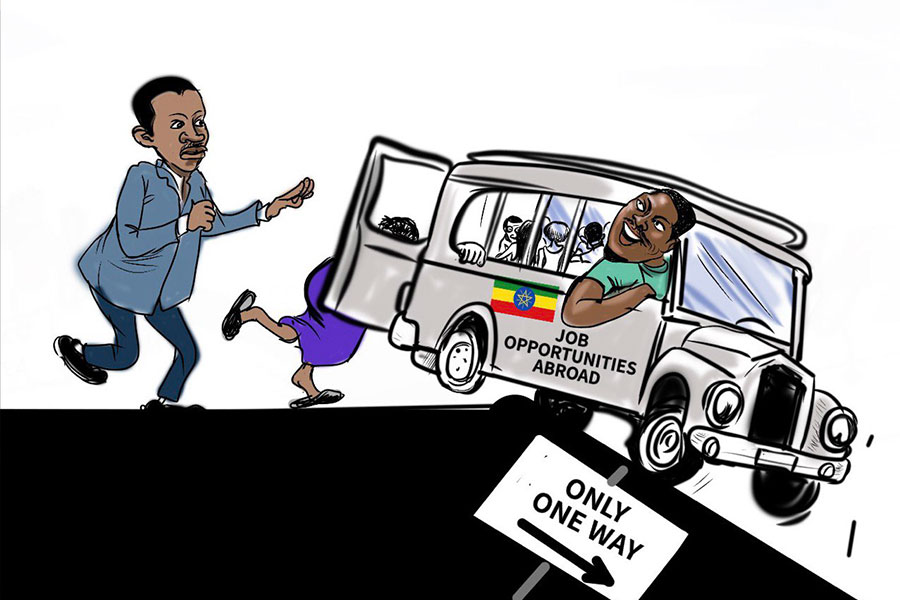

Mufariat Kamil, the minister of Labour & Skills, recently told Parliament that he...

Apr 13 , 2025

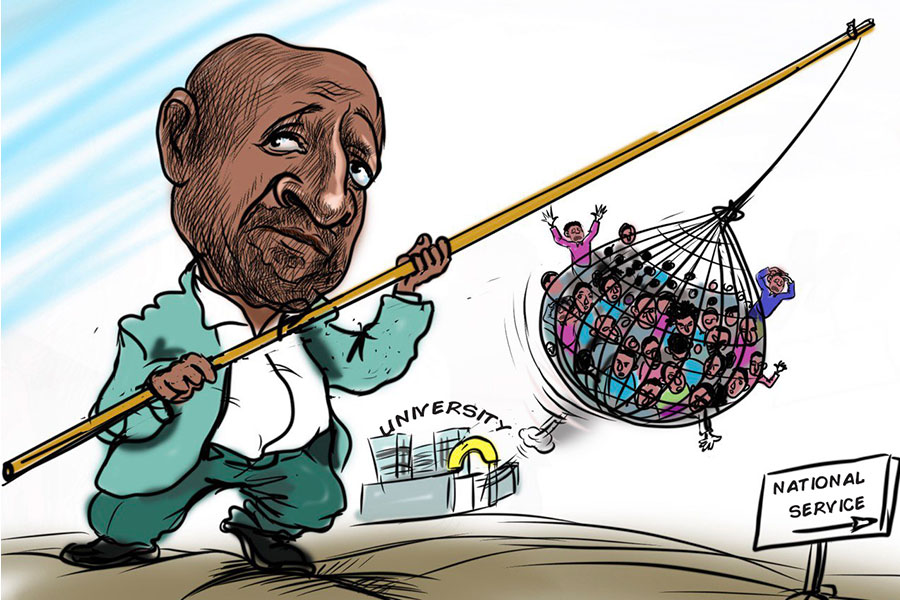

The federal government will soon require one year of national service from university...

May 3 , 2025

Oromia International Bank introduced a new digital fuel-payment app, "Milkii," allowi...

May 4 , 2025 . By AKSAH ITALO

Key Takeaways: Banks face new capital rules complying with Basel II/III intern...

May 4 , 2025

Pensioners face harsh economic realities, their retirement payments swiftly eroded by inflation and spiralling living costs. They struggle d...

May 7 , 2025

Key Takeaways Ethiopost's new document drafting services, initiated in partnership with DARS, aspir...